Swiss bank UBS surveyed 317 wealthy families with an average capital of $2.7 billion. It turned out that billionaires are investing not only in luxurious estates and cryptocurrencies, but are also preparing for the development of AI in a measured and cautious manner, reducing the share of private capital and returning to "boring" bonds. Vasyl Matiy, CEO and co-founder of Smart Family Office, senior venture partner of Toloka.vc, talks about investment strategies and mistakes that billionaire investors avoid.

Leading Swiss bank UBS has published its sixth annual research Global Family Office Report 2025. This report is a desk book for professional asset managers around the world. What key changes in investments has it highlighted compared to previous years?

This year, 317 wealthy families with an average capital of $2.7 billion participated in the survey. The study reveals the structure of these families' assets, the main trends in the distribution of their investments, and the key risks that investors pay attention to.

Most people imagine billionaire portfolios as a collection of luxury estates, private jets, and risky bets on cryptocurrencies. But the reality is different. Billionaires invest wisely, rely on data, and this year are acting even more cautiously than last year.

Current investment directions

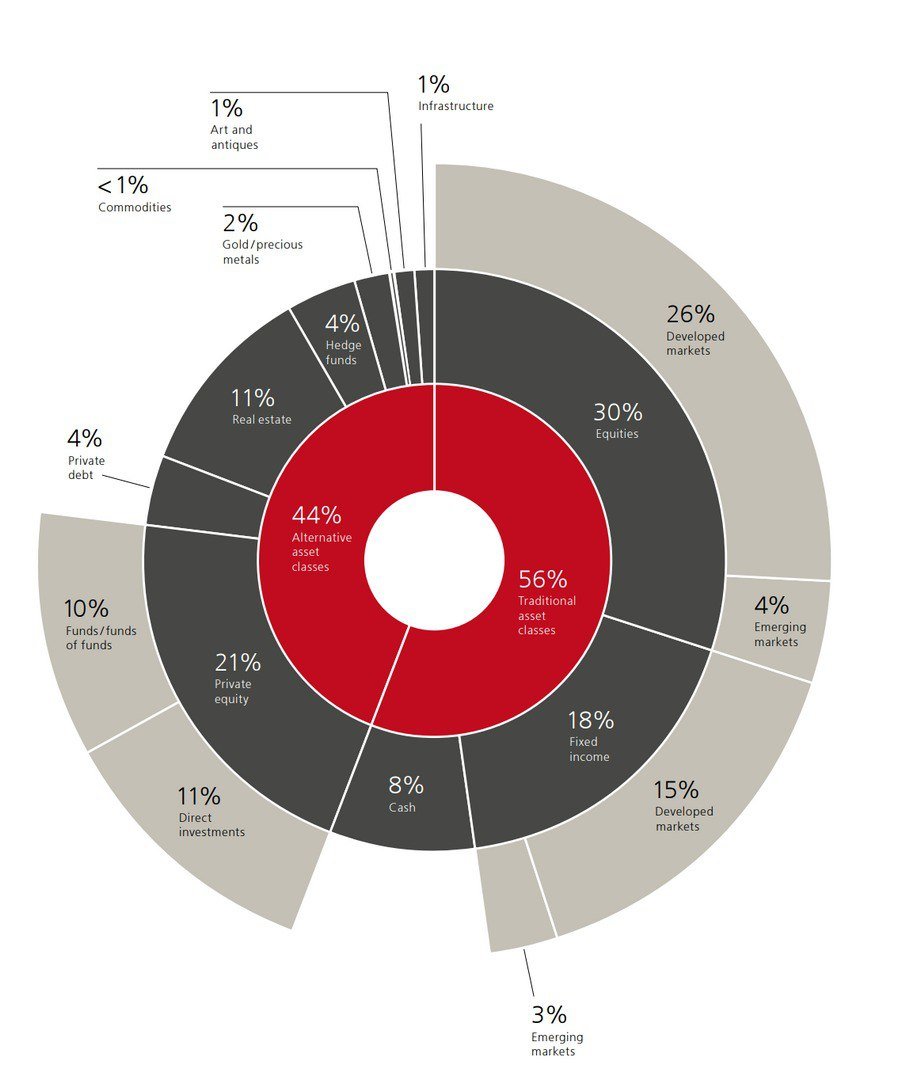

26% of respondents invest their funds in developed market stocks (41% in emerging markets) and plan to increase this share to 29% in 2026.

The two technology areas they are most familiar with are healthcare and/or medicine and electrification. Over a third (35%) say they are familiar with healthcare/medicine and have a clear investment strategy, while nearly three in ten (29%) say the same about electrification.

However, even in healthcare/medicine, almost half (48%) either do not have a clear investment strategy or are unfamiliar with the sector and eager to learn more.

18% of respondents are investing in bonds (15% in developed markets now, with the prospect of growing to 17%), because the returns finally compensate for the risks.

21% — in private equity (11% direct investments, 10% through funds). After a peak in 2023 at 22%, the share is reduced to 18% in anticipation of the exit season.

4% — into private debt, which is twice as much as in 2024, and this percentage continues to grow.

11% invest in real estate, gradually reducing the share due to the rising cost of financing and competition from bonds.

But the report highlighted large regional investment differences, as real estate profitability prospects depend on local markets.

For example, US family offices increased allocations from 10% in 2023 to 18% in 2024, while Latin Americans reduced their allocations from 7% to 6% and Southeast Asian families from 6% to 4%

For 8% For respondents, cash is a constant safety cushion.

Many American families have returned their wealth to the US because of the region's high growth rate, while some non-American families have invested there for safety reasons, given the growth in corporate profits and the depth of capital markets.

Investors are trying to understand what the world will look like next week, next year, and even next decade.

A pragmatic approach to available investment opportunities appears to be a defining factor for family offices, dictating how they pursue their sustainability and impact goals.

For example, over a third (37%) invest in clean tech/green tech/climate tech, and almost half (49%) have included health tech and other innovations in their portfolios. The main focus of involvement in investments in education is mostly is carried out through philanthropy (44% choose this path).

The extent to which family offices incorporate sustainability and social impact principles through their business operations, investments, or philanthropy varies by location. In a global context, the philanthropic and charitable activities of such structures are most often linked to sustainability.

Many of the survey respondents are focused on strategic philanthropy, seeking long-term change by addressing the root causes of problems rather than just providing short-term relief. Over a quarter of those surveyed (27%) are already focused on this approach or are trying to understand its context better.

Regarding the precious metals direction, investment allocations have increased globally (from 1% in 2023 to 2% in 2024), although they have a small share in portfolios against the backdrop of the high cost of gold.

Influencing factors

Four factors that really influence the decision to invest.

Profitability has returned. Families are choosing quality bonds instead of chasing every tech stock rally.

Considered risks, not blind faith in growth. They are reducing the share of private capital, but keeping the "powder dry" for attractive deals.

Generative AI — it’s a strategy, not a fad. 27% already have a separate allocation to artificial intelligence, and another 64% are actively forming one. In total, 75% of the surveyed investors believe that the biggest beneficiaries of generative AI will be banks/financial service providers,

Other emerging technologies of interest to family offices include blockchain and/or decentralized finance, 6G technologies, quantum computing, and agriculture and/or sustainable living.

AI in the office. 69% plans to use it for reporting, data visualization, and portfolio analytics for five years.

Family offices intend to use AI to improve efficiency and enhance their investment capabilities in the next five years, with over two-thirds (69%) saying they are likely to use AI for financial reporting/data visualization.

Four areas where most investors make mistakes.

Overweight public markets. The main mistake of novice investors is excessive portfolio concentration in public stock markets (60–80%), which leads to insufficient diversification, emotional decisions, and short-term focus.

Chasing trends after the fact. Billionaires take positions early and then give themselves time to do their thing.

Ignoring “boring” profitability. The annual return on a 6–7% private loan may be better than the expectation of double-digit returns on stocks.

Confusing activity with strategy. Only 35% families plan to adjust strategic allocations this year—patience is part of the advantage.

Investment advice from the richest

Evaluate each step in a 10-year perspective. First, take care of a solid foundation (quality bonds, real diversification), and only then look for big profits.

Invest in real assets where possible: small businesses, private deals, your own human capital. Incorporate technology not only into the portfolio, but also into processes.

Formulate a personal investment strategy on one page and stick to it.