Against the background of, to put it mildly, political uncertainty occurring in the world and the unpredictability of US policy regarding absolutely everything, the question arises: Shouldn't part of the cushion be converted into euros or other currencies?

First, it’s worth noting that it all depends on the goal. If a person is planning to move to Europe, it’s clear that it’s worth having more euros. But if it’s just a financial reserve “just in case,” then the question is different: doesn’t the concentration of the dollar create additional risks?

Let's look at this issue in two dimensions: in terms of a year and many years.

In the short term, the dollar looks quite confident.

1️⃣ First, the US economy has higher rates of economic growth compared to Europe and most developed economies. In 2024, US GDP grew by 2.7%. Other developed countries by an average of 1.7%. A similar situation is forecast for the end of 2025.

2️⃣ Second, the rate on the 10-year US bond higher than the rates in the EU and Japan. Therefore, they are attractive to investors and this supports demand for American assets and, of course, the dollar. And again, according to forecasts, the Fed will lower rates at a slower pace than in European countries.

3️⃣ Well, and politics “Make America Great Again” with increased domestic production, increased tariffs, and deregulation of industries could support the dollar.

But what about in the long term?

Could the dollar lose its status as the main reserve currency?

The main arguments in favor of “all is lost”:

- Share of the dollar in foreign exchange reserves countries are constantly fallingRussia and China have reduced their dollar reserves to less than 20% total

- China and India expand direct payments in yuan and rupees, reducing dependence on the dollar and its share in world trade

- China launched CIPS, which allows you to bypass SWIFT

- In 2023 RMB transactions increased at 47% in global trading operations

- US national debt exceeds 34 trillion dollars

- Fitch and Moody's already downgraded the US credit rating due to the growing deficit

- Central banks of 130 countries are investigating introduction of digital currencies (CBDC) that will be able to bypass the dollar as an intermediary

- Trump's protectionist policies may undermine confidence in the dollar and speed up all the processes described above

But it is worth sorting out all the risks gradually.

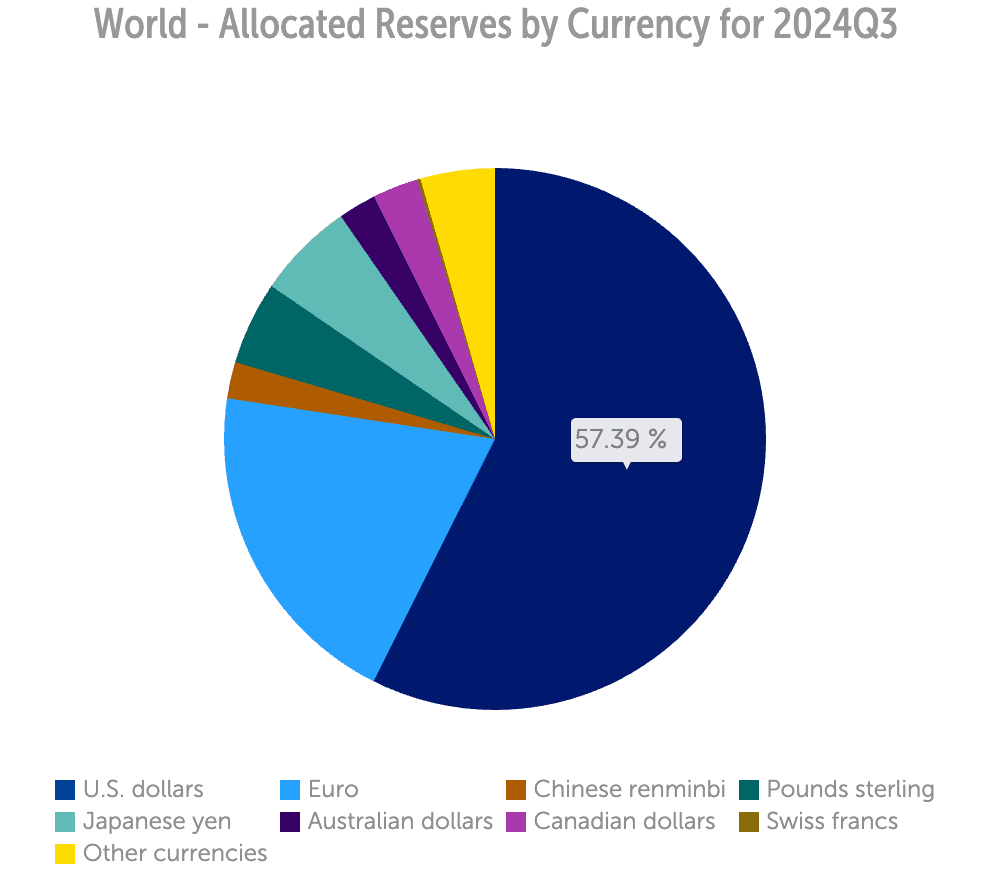

Despite all the talk about “de-dollarization,” share of the dollar in world reserves is still 57.39%, while the euro is 20.02%, and the yuan is only 2.17%. And although the share of the dollar is still on a downward trend, together the dollar and the euro form almost 80% of the world's foreign exchange reserves. The remaining 20% is distributed among several currencies with small shares.

The dollar is used in over 88% of global transactions, where it acts as a “middleman” in foreign exchange markets and minimizes costs for traders. This also creates protection through inertia: replacing the dollar is difficult, expensive, and complicated.

The dollar, euro, and pound sterling together account for almost 90 percent of international debt securities in circulation.

64% of world debt is denominated in dollars, and the dollar is used for 54% cross-border international payments between countries and companies involved in global trade.

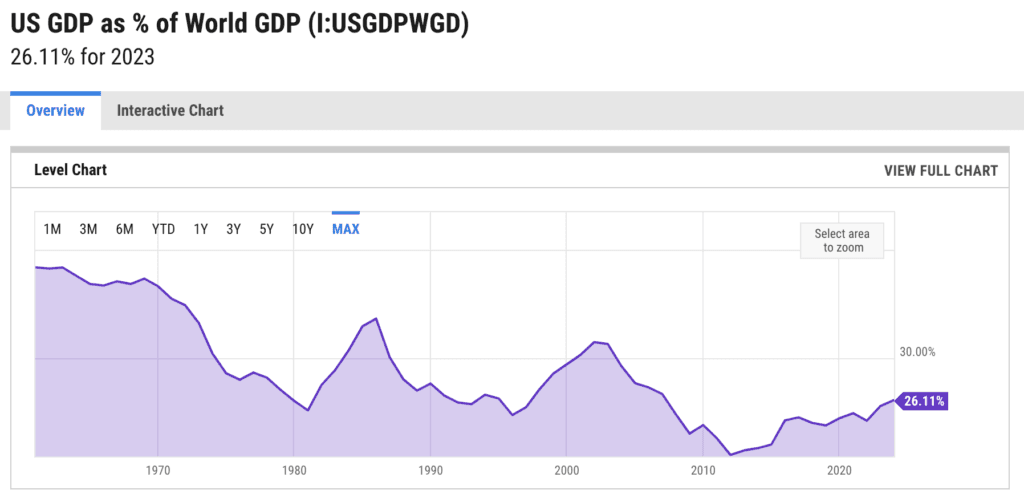

And although the US share in the global economy fell from 30% in the 2000s to 26% In 2024, the dominance of the dollar is still very clear.

All potential competitors, including the euro, yuan, or franc, have very limited opportunities to challenge the dollar in the near future.

Yes, the BRICS countries are working to create a multipolar global monetary system. But even on BRICS summit in 2024, approved the initiatives by members were very “fuzzy”, because the decisions are still more political in nature and there is no strategy for reconciling internal political and financial disagreements.

Yes, global payments using yuan almost doubled in 2023. But we are talking about share from 1.91% at the beginning of 2023 to 4.61% in November 2023. In addition, 80% use of yuan outside China takes place in Hong Kong – without Hong Kong, the international use of the yuan remains quite small.

In addition, there are important structural constraints on the international use of the yuan. Chief among these is that the yuan is not freely convertible. Foreign firms that hold yuan-denominated assets operate under the direct supervision of the Chinese government, whose interests do not always align with their own.

Finally, China's financial markets remain less developed and regulated. China's bond markets are still much less developed and less liquid, than the US Treasury bond markets. Although they have been valued at around $8 trillion in recent years, they pale in comparison to the US, which is pushing $30 trillion.

So will the dollar lose its status as the main reserve currency?

We see a gradual, small decline in the share of the US, and an increase in the share of other currencies in the global economy. But the changes are too small and the dominant position of the United States is beyond doubt. So it would be safe to say that in the long term, there is no need to worry about the dollar.

But the long-term advantage of the United States has been open borders, free trade, and transparency for investors and traders. The policies and statements of the president-elect cast a shadow over these advantages.

So it can be said that in the short term of one year there is no reason to worry (except for black swans, of course). But long-term confidence is better replaced by medium-term with monitoring the current situation and the consequences of the policies of the US presidential administration and the response to these policies by the rest of the world.

Regarding your own savings – diversification is always the best strategy. If part of the expenses are or are planned in euros, pounds, francs or yuan – put most of the reserve in this currency. If there are no problems with this, the dollar can occupy half of the financial cushion for the next few years.